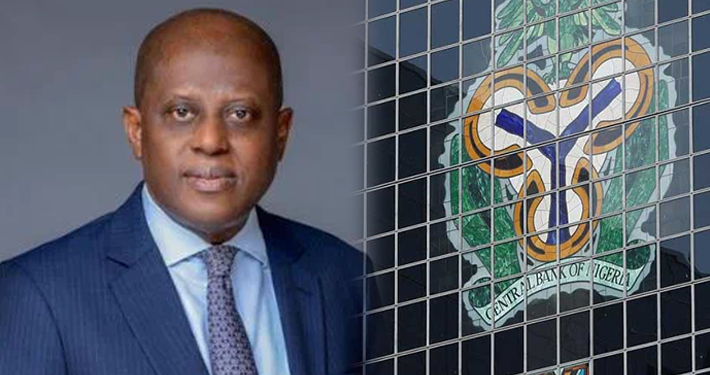

MPC will keep making efforts to reduce inflation rate – Cardoso

The Governor of the Central Bank of Nigeria, Dr Olayemi Cardoso, has said that the members of the Monetary Policy Committee (MPC) would not relent in their efforts to address Nigeria’s persistent inflation.

Cardoso made this known on Monday in an interview, stressing that interest rates would remain high for as long as necessary to tame inflation.

Cardoso made this known on Monday in an interview, stressing that interest rates would remain high for as long as necessary to tame inflation.

The apex bank’s position on addressing the inflation became apparent to Nigerians from the first MPC meeting held in February.

At the meeting, the MPC raised the benchmark lending rate by 400 basis points to 22.75 per cent, from 18.75 per cent. It has since been raised to 24.75 per cent.

During the interview, the CBN governor told the Financial Times that there was “every indication” that the monetary policy committee would “do whatever is necessary” to keep soaring inflation in check.

“They will continue to do what has to be done to ensure that inflation comes down,” he said.

The next MPC meeting is slated for May 20-21, as there are projections of a rate hike from the committee, even as inflation is forecast to rise.

Cardoso said he hoped that high rates would not be for too long and discourage investment and production.He maintained that raising rates had been essential.

“Hiking interest rates has had a dampening effect on the foreign exchange market, so that has begun to moderate. It’s not a zero-sum game. You lose on one side, you get on the other,” Cardoso said.

On fluctuations in the naira in recent times, the CBN governor said investors, who were likely to exit the economy in response to currency fluctuations, were now more comfortable with the market.

He said, “Let’s face it: for a long period of time, the CBN did not embrace orthodox monetary policies. We want to go back to using an orthodox method, and it will take us to where we want to go.”