CBN suspends processing fees on cash deposits till September 30

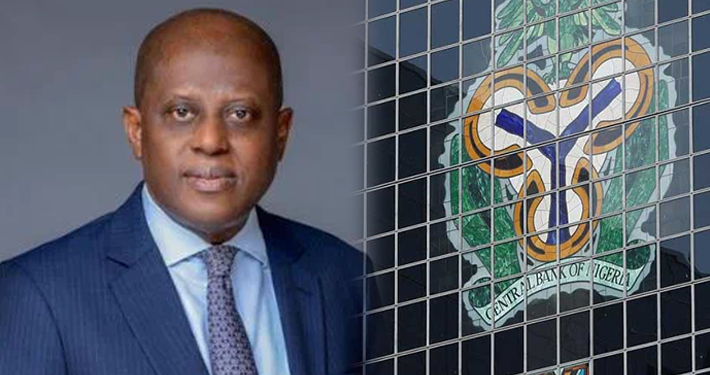

The Central Bank of Nigeria has instructed banks to suspend processing fees on cash deposits until September 30, 2024.

This directive, detailed in a circular dated May 6, 2024, and signed by Adetona Adedeji, the Director of Banking Supervision at the CBN, comes in response to concerns raised by bank customers regarding the recent implementation of processing fees for cash deposits starting on May 1.

Under the previous guidelines, banks were authorised to levy a two per cent charge on deposits exceeding N500,000 for individuals, while corporate account holders faced a two per cent charge on deposits surpassing N3 million.

This directive, detailed in a circular dated May 6, 2024, and signed by Adetona Adedeji, the Director of Banking Supervision at the CBN, comes in response to concerns raised by bank customers regarding the recent implementation of processing fees for cash deposits starting on May 1.

Under the previous guidelines, banks were authorised to levy a two per cent charge on deposits exceeding N500,000 for individuals, while corporate account holders faced a two per cent charge on deposits surpassing N3 million.

The statement read, “Please refer to our letter dated December 11, 2023, referenced BSD/DIR/PUB/LAB/016/023 on the above subject, suspending processing charges imposed on cash deposits above N500,000 for Individuals and N3,000,000 for corporates as contained in the ‘Guide to Charges by Banks, Other Financial Institutions and Non-Bank Financial Institutions’ issued on December 20, 2019.”

It further stated, “The Central Bank of Nigeria hereby extends the suspension of the processing fees of two per cent and three per cent previously charged on all cash deposits above these thresholds until September 30, 2024.”

Financial institutions were instructed to accept all cash deposits from the public without imposing any charges until the end of the third quarter.